The number of homes changing hands in the UK rose to the highest level on record in June, with 213,120 sales registered with HMRC.

The flurry of activity before changes to stamp duty rules in England, Wales and Northern Ireland made for the busiest month since the figures were first published in April 2005, during the housing boom that led up to the financial crash.

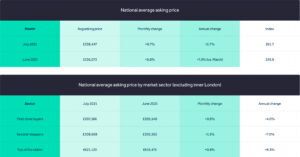

“Frenzied” UK housing market activity in the first half of 2021 pushed the average price of newly-listed properties to a record-breaking £338,447, according to the latest data from property portal Rightmove.

The firm said a record figure had been achieved in each of the past four months. The average property price is now £21,389 (6.7%) higher than at the start of 2021.

From May to June 2021 alone, the average property price rose by £2,374. Rightmove said this was the largest increase recorded at this time of year since 2007.

Rightmove added that the combination of 140,000 sales being agreed in the first half of 2021, plus 85,000 fewer listings compared with the long-term average, had produced a shortfall of 225,000 homes for sale which, if available, would have helped to maintain a more normal level of property stock for sale and would have helped stabilise prices.

The boom in sales demand and consequent greatest ever imbalance with supply have been most notable in the more expensive sectors of the market. Rightmove’s “top of the ladder“ sector mainly includes homes that are detached with four bedrooms or more. Here has experienced the largest imbalance in terms of supply and demand since the start of 2021, with a 39% surge in sales but a 15% fall in numbers.

Tim Bannister, Rightmove’s Director of Property Data says:

“First-time buyers are currently benefitting from their sector having the most buyer-friendly conditions. Choice is still more limited when compared to the same period in 2019, but price rises are the most subdued of any sector. Saving a deposit is still very hard, but 5% is now an option, and with many paying, rising rents, buying your own home on a lower deposit is becoming an opportunity again.

The opportunity is also there for property owners to come to market, as it’s still a great sellers’ market despite the recent end of the tax holiday in Wales and its scaling back in England. We’ve also seen a much more efficient housing market over the past year, with the strong buyer demand and faster churn of homes leading to a much higher percentage of sellers finding a buyer for their home, and fewer unsold homes being withdrawn from the market.

Buyer sentiment remains strong, and the growth in new households combined with people living longer and having changed housing needs is exacerbating long-term housing stock shortages.”

For more information about our property investment opportunities, please contact us.