This year has been one of the busiest for the housing market in more than a decade.

Zoopla’s estimates show that there will be 1.5 million sales this year, with the total value of homes changing hands at £473bn, some £95bn higher than in 2020.

The trends driving the market have been well discussed – a ‘reassessment of home’ prompted by the pandemic, a ‘search for space’, low mortgage rates, better access to mortgages for first-time buyers, and, of course, the stamp duty holiday.

The end of the stamp duty holiday on the 30th of September 2021 has failed to dampen demand from potential buyers, which is up 30% on the five-year average.

Thanks to the tapering-off period at the end of the holiday, the anticipated ‘cliff edge’ is nowhere to be seen and the pandemic-induced boom still has further to run.

So, what has the impact been over the last two months? Minimal. That’s not to say that buyer demand remains at the unsustainable highs seen back in March and April, but it remains steadily above the five-year average, some 28% higher, suggesting those pandemic drivers of activity in the market remain in play.

Zoopla Research recently conducted a nationally representative survey of UK households which found that 22% remain ‘eager’ or ‘very eager’ to move home in the next 18 months as a direct result of the pandemic, significantly higher than the usual 5% in a normal market. As offices confirm their new working practices, more households will be reflecting on their options to move home.

Another factor which may increase consideration around moving is the increased housing equity among homeowners – the average value of a home has risen by nearly £50,000 over the last five years. In one in seven local authorities across the UK, 2/3rds of homes have risen by more than the average, giving households more scope to make their next move.

Zoopla forecast that house prices will end 2022 at +3%, a slowing in growth from today’s +6.6%. We expect c.1.2m sales next year, down from 1.5m this year, and back in line with the average transaction levels seen in recent years.

The firm expects the house price gains seen over the past year to bring more sellers to the market in the coming months. However, a continued low supply will support price inflation. It points out that housing remains affordable in many markets, and competition among mortgage lenders will also keep rates low, leading to continued strong appetite in the sector next year.

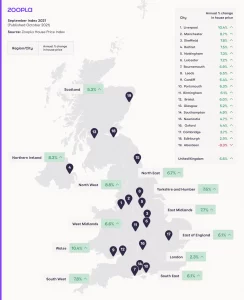

Reflecting the regional trend, the cities with the strongest price growth were Liverpool, Manchester and Sheffield, all located in northern regions.

At the other end of the spectrum, London, where the typical property costs 11.5 times average earnings, recorded price growth of just 2.3%.

Reference: Zoopla.co.uk / propertyindustryeye.com