The average price of a UK home hit a record level for the third month in a row in April 2022, according to data from property portal Rightmove.

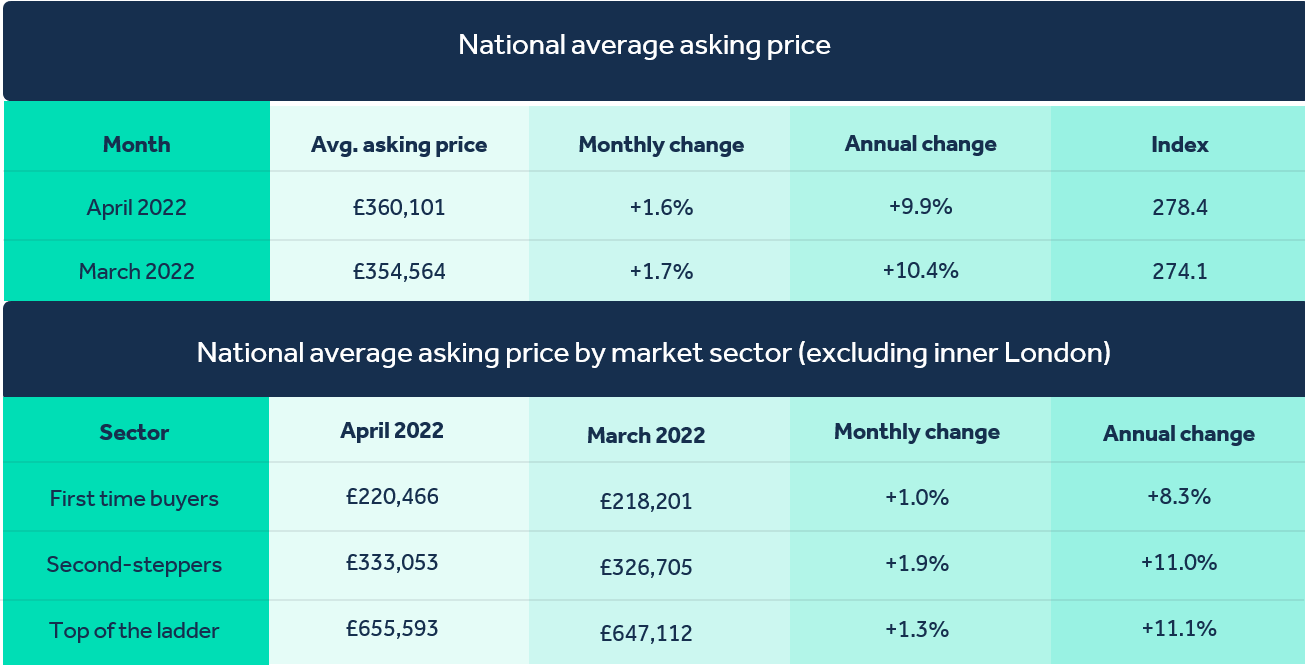

Its house price index shows asking prices growing 1.6% month-on-month, or £5,537, bringing the average property price to £360,101 in April. Annual price growth stood at 9.9%.

Rightmove says the average property price has jumped by more than £19,000 in the past three months, the largest quarterly increase it has ever recorded. And property values are at record levels in each of the three market sectors it covers – lower, middle and upper – only the second time since 2007 the company had reported this scenario.

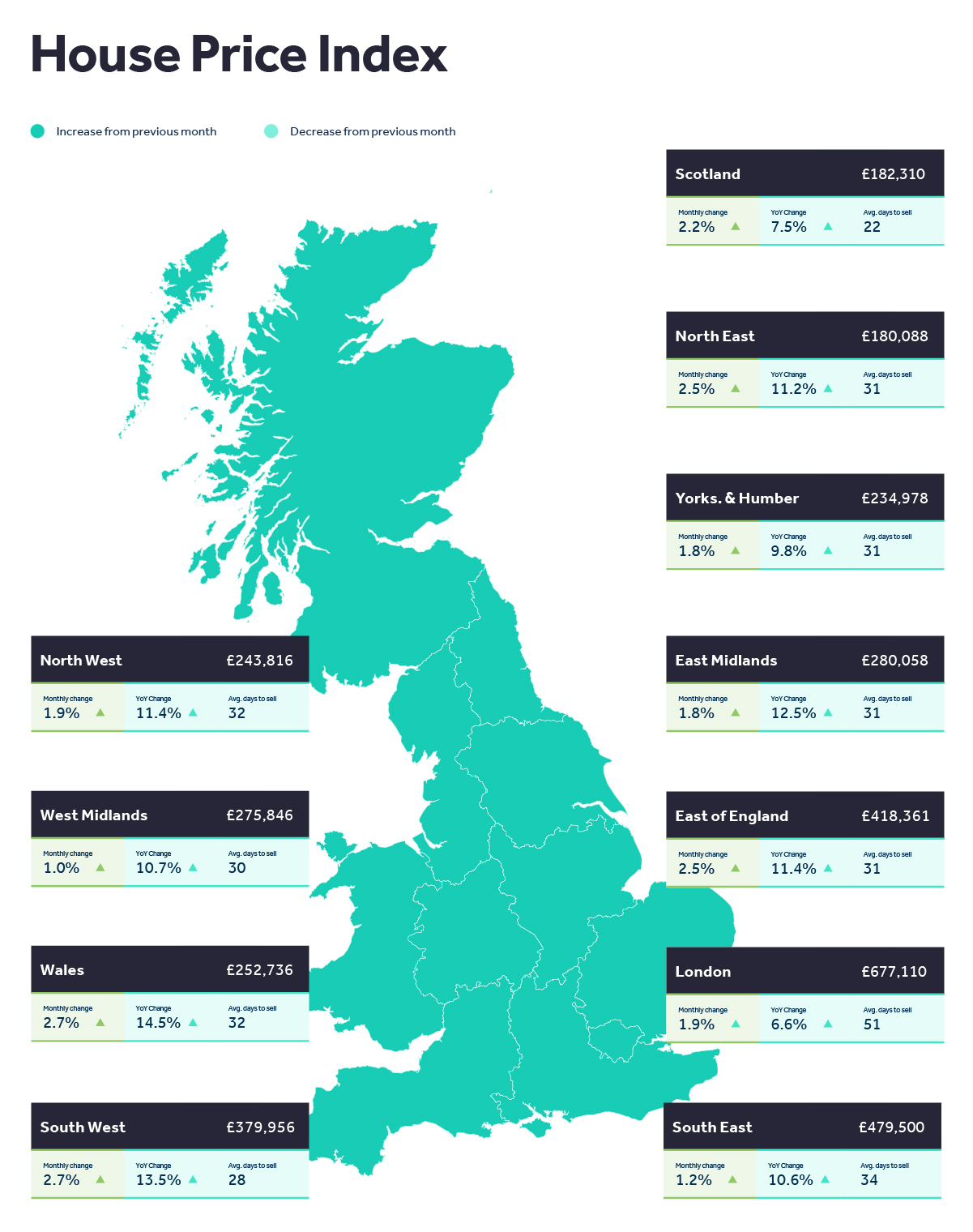

With not enough property available on the market, sellers are able to find a buyer quicker than ever previously seen by Rightmove, and twice as quickly as in the same period in the more normal market of 2019. This momentum is despite the growing economic headwinds, though we forecast that these headwinds will slow the pace of price rises as the year progresses.

Tim Bannister, Rightmove’s Director of Property Data comments: “With three new monthly price records in a row, 2022 has started with price-rise momentum even greater than during the stamp-duty-holiday-fuelled market of last year. While growing affordability constraints mean that this momentum is not sustainable for the longer term, the high demand from a large number of buyers chasing too few properties for sale has led to a spring price frenzy, a hat-trick of record price months, and the largest price increase for a three-month period Rightmove has ever recorded. The strong momentum has carried over from last year and, combined with the impetus of the spring moving season, has delivered the quickest selling market we’ve ever seen. The high speed of the market and competition among buyers when making an onward move will be deterring some owners from putting their homes up for sale. However, if you can secure both a quick sale and a quick purchase then it’s a lot less stressful than the uncertainties of a slower market when finding a buyer for your own home can drag on for months or not happen at all. Over 125,000 new sellers have taken advantage of the great sellers’ market this month, but more are needed in all areas and in all property sectors to meet high buyer demand.”

This time in 2019, the average time to sell was 67 days. It now stands at an average of just 33 days before a property is marked as sold subject to contract on Rightmove. Of course, this is an average, and some popular properties are sold within days while others that are less desirable may still take months.

This fastest-ever speed of sale means that 53% of properties that sell are now selling at or over their final advertised asking price, the highest percentage we have ever measured. Overall, our analysis shows that properties are achieving 98.9% of the final advertised asking price on average, which is also the highest percentage since our records began. However, the pace of price rises does now appear to be tailing off a little, with this month’s increase of 1.6% being lower than the 1.7% and 2.3% in the previous two months. Whilst it is normal to see modest seasonal price falls in several months of the second half of the year, with stock remaining at record lows and underlying strong demand, we do not expect these falls to be any more significant than usual this year.

Bannister says: “The economic headwinds of strongly rising inflation and modestly rising interest rates are being kept at bay by the even stronger tailwind of property market momentum that has carried over from last year. 2021 saw four consecutive monthly price records from April through to July and I would not bet against that being bettered this year as we are already at three consecutive records in April. There are some early signs of an easing off from the frenetic pace of price rises, and buyer enquiries to agents are down by 16% on last year’s stamp-duty frenzy. However incredibly, buyer enquiries are still 65% above the more normal market of 2019 and the number of sales agreed is up 21%. While there is growing economic uncertainty, our current market statistics show there is greater certainty that your property will sell more quickly than ever before, and likely at a record price. It can’t and won’t continue like this, but with the demand and supply imbalance being so out of kilter, it looks like any substantial slowdown will be gradual in coming and be a soft rather than hard landing. It seems likely that the supply/demand mismatch will remain for at least the rest of this year. Even with some economic uncertainty, where you live and your home is such a fundamental decision for people that it will remain a priority for many.”

#

For information on our property investment opportunities, please get in touch.

Source: Rightmove